Table of Contents

Microfinance

Microfinance is a valuable resource that intends to address the money related necessities of individuals who are by and large banished from standard monetary organizations.

It offers restricted scope money related kinds of help like advances, hold assets, and insurance to low-pay individuals, financial specialists, and autonomous organizations, helping them with building assets, produce pay, and work on their lifestyle.

By getting over money related openings and connecting with underserved networks, microfinance expects a pressing part in progressing monetary thought and social new development.

The Arrangement of encounters and Improvement of Microfinance

The groundworks of microfinance can be followed back to the mid 1970s when monetary expert Muhammad Yunus led the possibility of microcredit in Bangladesh. His profound work with the Grameen Bank laid out the basis for current microfinance, displaying the capacity of little credits to lift people out of destitution.

From there on out, microfinance has grown basically, reaching out past microcredit to integrate numerous money related things and organizations uniquely designed to the various necessities of clients. Today, microfinance associations (MFIs) work all around the planet, serving a considerable number of clients and significantly affecting dejection easing up and money related reinforcing.

The Meaning of Microfinance in Monetary Development

Microfinance expects a critical part in money related improvement by giving permission to financial organizations to underserved peoples.

By empowering individuals and privately owned businesses with the capital they need to start or expand their undertakings, microfinance quickens business, develops work creation, and drives monetary turn of events.

Additionally, microfinance propels money related training and fuse, engaging individuals to manufacture assets, direct possibilities, and further foster their financial flourishing. As a stimulus for thorough monetary new development, microfinance adds to poverty decline, social steadfastness, and useful outcome in networks all around the planet.

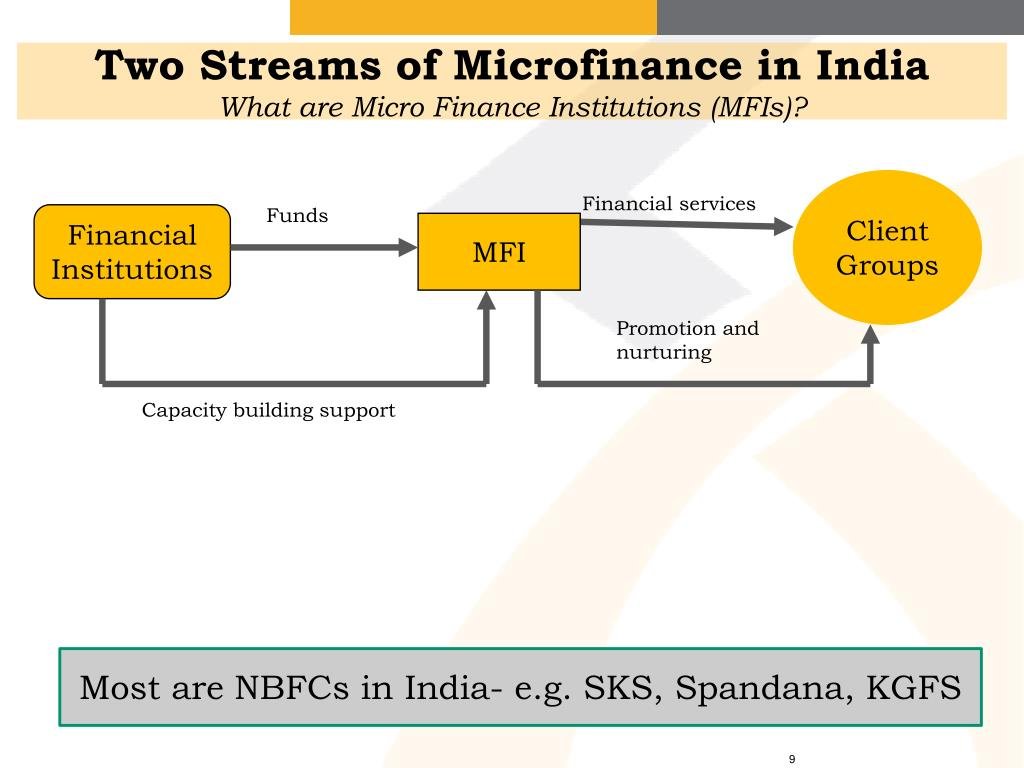

Microfinance Foundations (MFIs): Focal individuals in Money related Inclusion

Microfinance foundations (MFIs) are the groundwork of the microfinance region, filling in as focal individuals in advancing financial thought and drawing in underserved masses.

These foundations range from standard banks to not-revenue driven affiliations and cooperatives, each with its own principal objective and method for managing conveying microfinance organizations.

MFIs give a considerable number of financial things and organizations, including microloans, ledgers, security, and money related guidance, custom fitted to the uncommon necessities of their clients.

By using creative strategies and advances, MFIs stretch out permission to financial organizations, advance business, and drive positive social impact in networks all over the planet.

Understanding Microfinance Models: From Grameen to Town Venture assets and Advance Associations

Microfinance incorporates an alternate bunch of models and approaches, each expected to meet the specific necessities of clients and organizations.

One of the most striking models is the Grameen model, initiated by Muhammad Yunus, which highlights bundle crediting and social assurance to empower women and advance financial joining.

Another well known model is the Town Save assets and Credit Connection (VSLA) model, which engages neighborhood speculation assets and advancing among people from relaxed social events.

Various models consolidate microfinance banks, credit affiliations, and high level advancing stages, each offering wonderful advantages and challenges in serving the necessities of microfinance clients.

Empowering Social class Through Microfinance

At its middle, microfinance is tied in with something past contribution money related kinds of help — it’s connected to empowering individuals and organizations to accept control over their financial possibilities.

By giving people induction to capital, microfinance enables them to place assets into their tutoring, clinical consideration, and associations, breaking the example of poverty and setting out open entryways for long stretch prospering.

Furthermore, microfinance progresses social association and flexibility by developing a sensation of neighborhood and cooperation among borrowers. As a power for reinforcing and social change, microfinance might potentially change lives and motivate entire organizations.

Microfinance and Poverty Facilitating: Changing Lives

One of the most persuading parts regarding microfinance is its ability to lift people out of poverty and make pathways to monetary independence.

By giving little advances and other financial organizations to low-pay individuals and business visionaries, microfinance enables them to start or develop their associations, increase their wages, and work on their assumptions for regular solaces.

Studies have shown the way that permission to microfinance can uncommonly influence family government help, provoking improvements in food, prosperity, and preparing results.

By zeroing in on the primary drivers of poverty and empowering individuals to create sensible occupations, microfinance might perhaps break the example of intergenerational desperation and roll out getting through improvement in networks all around the planet.

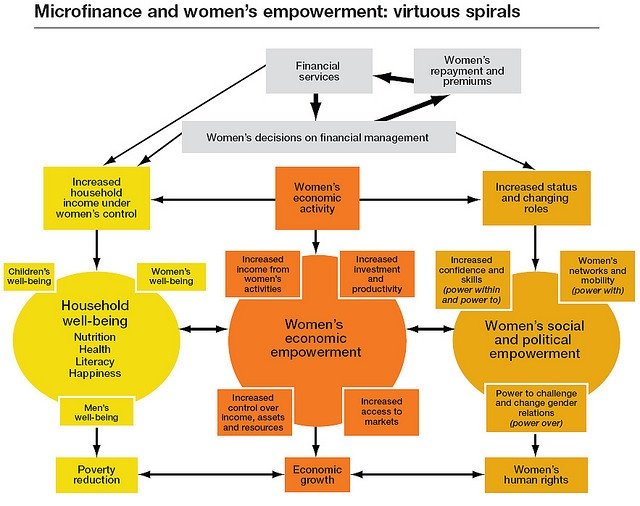

The Occupation of Microfinance in Women’s Empowerment

Microfinance has emerged as a fundamental resource for moving direction consistency and women’s reinforcing by outfitting women with induction to financial resources, open entryways, and dynamic power.

In numerous districts of the planet, women face colossal obstacles to getting to formal money related organizations, as confined adaptability, nonattendance of assurance, and biased acknowledged rehearses. Microfinance keeps an eye on these deterrents by offering fitted money related things and organizations that deal with the unique necessities and tendencies of women borrowers.

By drawing in women with money related opportunity and control over their resources, microfinance engages them to place assets into their associations, tutoring, and families, opening their greatest limit as issue solvers and progress in their organizations.

Microfinance Things and Organizations: Redid Deals with any consequences regarding the Underserved

Microfinance foundations offer numerous things and organizations expected to meet the varying necessities of their clients, including microloans, speculation records, assurance, and financial guidance.Microloans, regularly implied as microcredit, give restricted amounts of income to financial specialists and privately owned businesses to start or expand their undertakings.

Ledgers enable clients to build assets, manage risks, and plan for the future, while insurance things shield them against unforeseen events like sickness, crop frustration, or disastrous occasions. Money related guidance programs outfit clients with the data and capacities they need to make informed financial decisions and work on their money related training.

By offering a sweeping set-up of money related things and organizations, microfinance establishments draw in clients to achieve their goals, manufacture adaptability, and further foster their in everyday financial success.

Challenges and Entryways in Microfinance

Disregarding its many benefits, microfinance faces a couple incites and important entryways as it continues to create and develop.

One of the principal hardships is ensuring the practicality and flexibility of microfinance exercises, particularly in country and underserved locales where structure and resources may be confined. In addition, microfinance associations ought to investigate managerial requirements, direct credit risk, and acclimate to changing business area components to remain serious and solid.

Regardless, with these hardships come open entryways for progression, facilitated exertion, and impact. By using development, creating associations, and taking on endorsed systems, microfinance establishments can overcome obstructions and open new opportunities to stretch out permission to financial organizations and roll out certain social improvement.

Microfinance Impact Assessment: Assessing Success

Assessing the impact of microfinance programs is principal for surveying their suitability, perceiving locales for improvement, and enlightening unique cycles. Impact assessment incorporates following key execution pointers, for instance, credit repayment rates, business advancement, family pay levels, and destitution decline results.

Emotional methodologies, for instance, client interviews, focus gathering discussions, and logical examinations give significant pieces of information into the social and money related impact of microfinance interventions.

By completely looking over their impact, microfinance associations can display their value to accomplices, attract adventure, and drive positive change in the organizations they serve.

Government Game plans and Rules in Microfinance

Government methodologies and rules expect an essential part in embellishment the microfinance scene, ensuring client security, progressing money related robustness, and empowering an engaging environment for microfinance foundations to thrive.

Regulatory frameworks shift starting with one country then onto the next, for specific states taking on strong of poor plans and catalysts to help microfinance advancement, while others force inflexible rules to ease risks and protect customer interests.

Strong rule requires changing the prerequisite for client security with the necessity for improvement and money related thought, discovering a congruity that propels unfaltering quality, straightforwardness of some sort or another, and obligation in the microfinance region.

Advantages of Microfinance

1. Monetary Inclusion:

Microfinance assumes a significant part in advancing monetary consideration by stretching out monetary administrations to underestimated populaces, including low-pay people, ladies, and country networks.

By giving admittance to bank accounts, microloans, and protection items, microfinance empowers people to partake in formal monetary frameworks, construct resources, and oversee gambles successfully.

2. Destitution Alleviation:

One of the main advantages of microfinance is its ability to lift individuals out of destitution. Microloans engage business visionaries to begin or extend their organizations, produce reasonable wages, and work on their expectations for everyday comforts.

Furthermore, investment accounts and monetary education programs assist people with building monetary strength, break the pattern of neediness, and make pathways to financial autonomy.

3. Ladies’ Empowerment:

Microfinance significantly affects ladies’ strengthening, empowering ladies to defeat financial hindrances, state their organization, and accomplish monetary independence.

Studies have shown that ladies who access microfinance administrations experience more noteworthy dynamic power, further developed admittance to assets, and upgraded financial status inside their families and networks.

By advancing ladies’ business venture and financial investment, microfinance adds to orientation correspondence and social advancement.

4. Business and Occupation Creation:

Microfinance energizes business and occupation creation by giving cash-flow to private ventures and new companies.

Microentrepreneurs use microloans to put resources into useful resources, buy stock, and grow their tasks, accordingly animating monetary movement and setting out business open doors for others in their networks.

In addition, fruitful microenterprises add to nearby monetary turn of events, create charge incomes, and cultivate lively pioneering biological systems.

5. Local area Development:

Microfinance encourages local area improvement by engaging people to put resources into fundamental administrations and framework projects.

Microfinance clients frequently use credits to back schooling, medical care, lodging, and clean water drives, in this manner working on personal satisfaction and social prosperity.

Furthermore, microfinance organizations assume a reactant part in preparing local area assets, advancing social union, and tending to neighborhood improvement needs.

6. Monetary Education and Empowerment:

Microfinance advances monetary education and strengthening by giving clients the information, abilities, and certainty to settle on informed monetary choices.

Monetary schooling programs presented by microfinance establishments furnish clients with fundamental cash the executives abilities, planning methods, and pioneering expertise, empowering them to explore monetary difficulties, plan for the future, and create financial momentum over the long run.

7. Risk Alleviation and Resilience:

Microfinance assists people and networks with building versatility against monetary shocks and vulnerabilities. Bank accounts and protection items presented by microfinance foundations empower clients to gather crisis reserves, safeguard against unanticipated costs, and adapt to unfriendly occasions like sickness, crop disappointment, or catastrophic events.

By giving a security net during seasons of emergency, microfinance upgrades family steadiness and diminishes weakness to neediness.

8. Social Effect and Empowerment:

Past its financial advantages, microfinance creates positive social effect by advancing social incorporation, local area strengthening, and municipal commitment.

Microfinance clients frequently structure fortitude gatherings or cooperatives, where they support one another, share information, and promoter for their privileges aggregately.

Besides, microfinance cultivates a feeling of pride, confidence, and organization among clients, enabling them to state their freedoms, voice their interests, and take part effectively in dynamic cycles at the neighborhood and public levels.

Basically, microfinance is an extraordinary power that goes past monetary help, enabling people, elevating networks, and catalyzing supportable turn of events.

By cultivating monetary consideration, business, and social strengthening, microfinance adds to destitution decrease, orientation correspondence, and comprehensive development, preparing for a more evenhanded and prosperous future for all.

Conclusion:

All in all, microfinance remains as an encouraging sign and a chance for a large number of people all over the planet who are barred from conventional financial frameworks.

Through admittance to monetary administrations, for example, microloans, bank accounts, and protection items, microfinance enables business people, reduces destitution, advances orientation fairness, and cultivates comprehensive financial development.

The advantages of microfinance stretch out past monetary help, including social strengthening, local area advancement, and flexibility building. As we explore the intricacies of worldwide turn of events, microfinance stays a useful asset for driving positive change, making pathways to flourishing, and fabricating a more evenhanded and maintainable future for all.

(FAQs):

1. What is microfinance, and how can it work?

– Microfinance alludes to the arrangement of monetary administrations, for example, microloans, bank accounts, and protection items to low-pay people and underserved networks. Microfinance establishments (MFIs) regularly offer these administrations to clients who need admittance to conventional financial frameworks, empowering them to begin or grow organizations, assemble resources, and work on their expectations for everyday comforts.

2. How does microfinance benefit ladies and minimized communities?

– Microfinance assumes a vital part in advancing orientation fairness and social consideration by furnishing ladies and underestimated networks with admittance to monetary assets, valuable open doors, and dynamic power. By engaging ladies with monetary freedom and command over their assets, microfinance assists them with defeating financial boundaries, affirm their organization, and accomplish financial strengthening.

3. What are a portion of the difficulties confronting the microfinance sector?

– Regardless of its many advantages, the microfinance area faces a few difficulties, including restricted admittance to capital, administrative imperatives, and the gamble of over-obligation among clients. Also, microfinance foundations should explore functional difficulties, for example, credit risk the board, portfolio broadening, and guaranteeing supportability and adaptability of their tasks.

4. How is the effect of microfinance measured?

– The effect of microfinance is estimated utilizing different markers, including advance reimbursement rates, business development, family pay levels, destitution decrease results, and social strengthening pointers. Subjective strategies, for example, client interviews, center gathering conversations, and contextual investigations are likewise used to evaluate the social and monetary effect of microfinance intercessions.

5. What are a few arising patterns in the microfinance sector?

– Arising patterns in the microfinance area incorporate the reception of advanced advances, the reconciliation of ecological and social contemplations into microfinance activities, and the ascent of creative supporting components, for example, influence effective money management and social money. Also, there is developing acknowledgment of the requirement for client-driven approaches and dependable money standards to guarantee that microfinance keeps on helping those it serves while limiting possible dangers and adverse consequences.